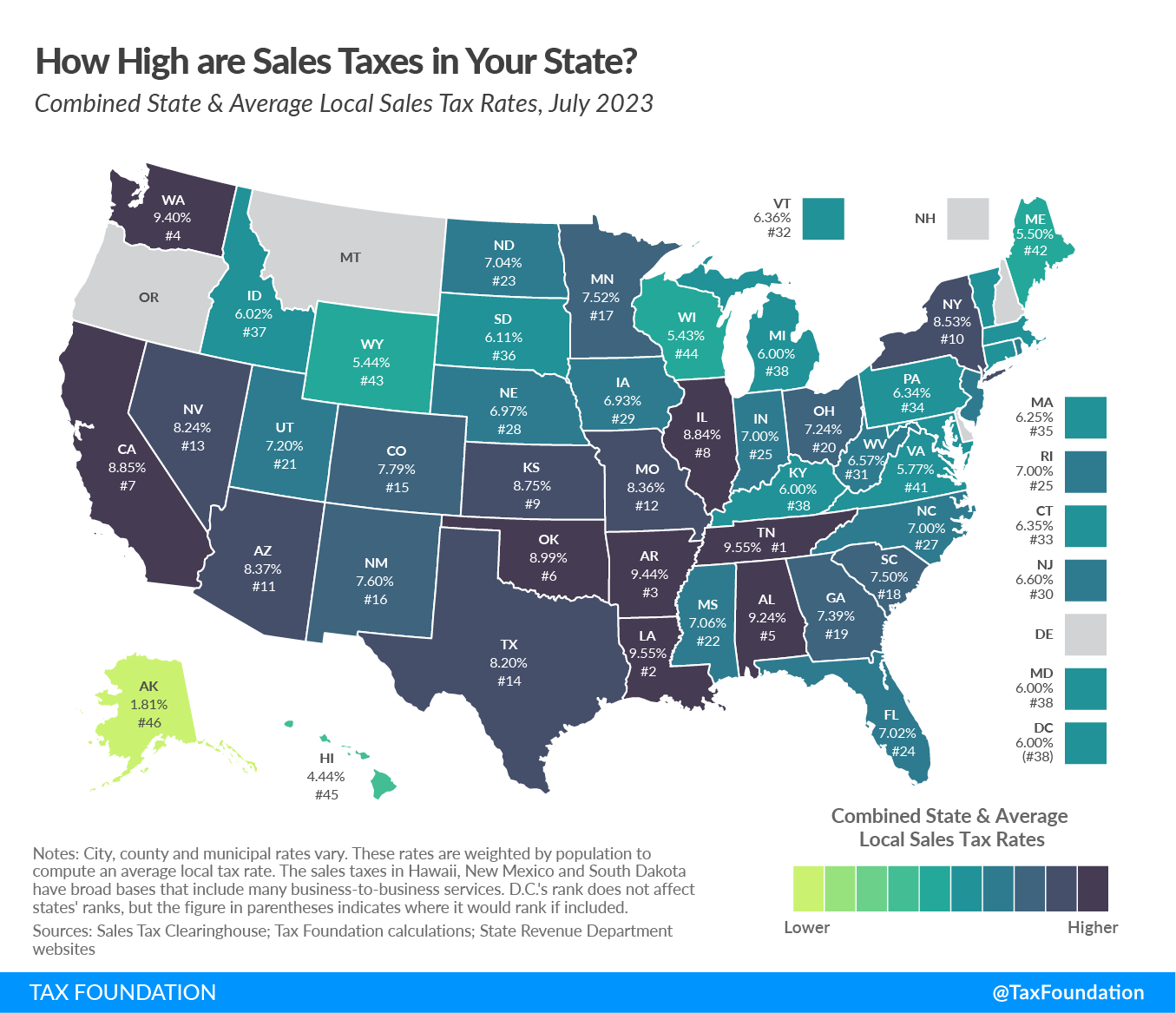

Sales Tax Calculator 2025 Arkansas. Arkansas has a 6.5% statewide sales. Then, identify the local sales tax rates, varying across counties, cities, and districts.

The local sales tax rate applied on the city level in arkansas ranges between 0% and 3.5%. The arkansas state sales tax rate is 6.5%, and.

Sales Tax Calculator 2025 Arkansas Images References :

Source: zamp.com

Source: zamp.com

Ultimate Arkansas Sales Tax Guide Zamp, The springdale, arkansas, general sales tax rate is 6.5%.

Source: maxwelllandreth.pages.dev

Source: maxwelllandreth.pages.dev

Tax Brackets 2025 Arizona State Cele Meggie, To determine the 2025 ar sales tax rate, start with the statewide sales tax rate of 6.5%.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2025 year of assessment Just One Lap, Arkansas sales and use tax rates in 2025 range from 6.5% to 11.5% depending on location.

Source: ar-us.icalculator.com

Source: ar-us.icalculator.com

4.089k Salary After Tax in Arkansas US Tax 2025, Free calculator to find the sales tax amount/rate,.

Source: www.pinterest.com

Source: www.pinterest.com

Sales tax calculator for Arkansas City, Kansas, United States in 2018, Arkansas has state sales tax of 6.5% , and allows local.

Source: newark2.remotepc.com

Source: newark2.remotepc.com

State Of Ohio Employee Calendar 2025 Printable And Enjoyable Learning, Arkansas has a 6.5% statewide sales.

Source: calculator-online.info

Source: calculator-online.info

Arizona Sales Tax Calculator 2025 State, County & Local Rates, Exact tax amount may vary for different items.

Source: ar-us.icalculator.com

Source: ar-us.icalculator.com

359.098k Salary After Tax in Arkansas US Tax 2025, Arkansas sales and use tax rates in 2025 range from 6.5% to 11.5% depending on location.

Source: robertorodri.pages.dev

Source: robertorodri.pages.dev

Tax Brackets 2025 Ontario Online Mead Stesha, The average combined sales tax in arkansas state is 8.537%.

Source: ar-us.icalculator.com

Source: ar-us.icalculator.com

49.7k Salary After Tax in Arkansas US Tax 2025, Sales tax rate = s + c + l + sr.

Category: 2025